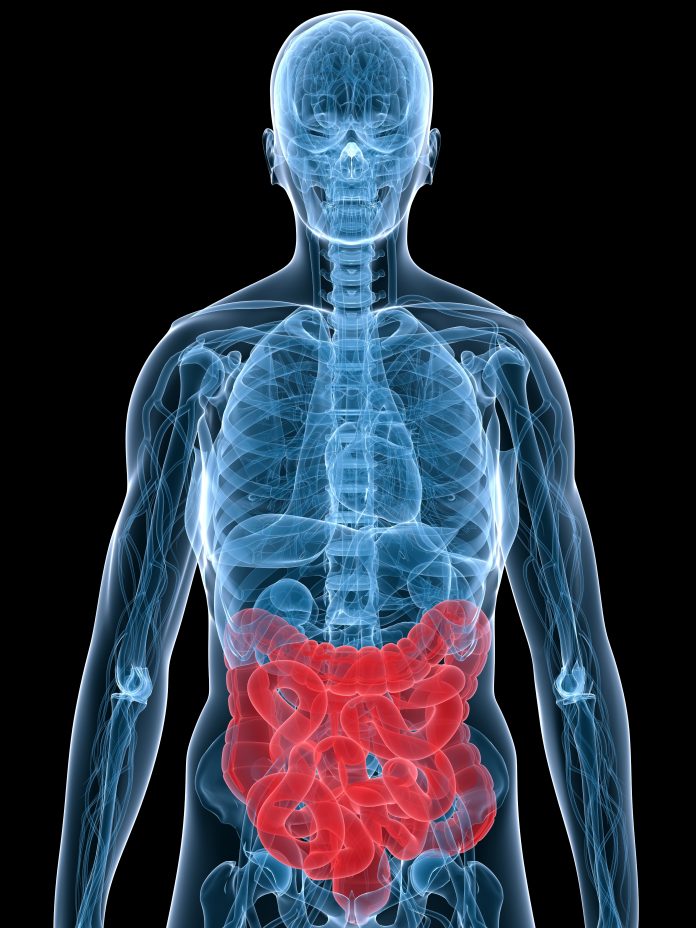

The importance of gut health has long been recognised by health professionals. But, as with many health learnings, it takes time for such knowledge to be widely adopted by the broader community.

Fortunately, it seems that interest in gut health is on the rise in Australia. This can be witnessed both through the increase of prebiotic- and probiotic-boosted products on the market, especially in the processed food sector, and also from the consumers themselves.

According to global market analyst Mintel, food drink and supplement product launches featuring a digestive health claim grew by 23% over the five years to May 2021.

These launches were not limited to categories such as drinking yogurt and liquid cultured milk, which are already widely regarded to aid gut health.

They also extended into vitamins, minerals, tea – even seasonings, cold cereals, and meal replacements.

Looking specifically at prebiotics, food and beverage products containing prebiotic-related ingredients grew at a rapid pace during 2012-13 and 2017-19, with more than 52,000 new products globally.

Among the sub-categories, the chocolate category is growing quickly. In terms of positioning claims, the main claims are vitamin/mineral fortified, high protein, and high/added fibre.

Global interest

This surge in digestive-health marketed products has no doubt helped to raise awareness of the importance of a healthy gut. Global bioscience company Chr. Hansen, recently conducted a quantitative research study to gauge consumer awareness of probiotics and their potential benefits.

The data was collected from 16,000 people in 2021 and the results reflect a strong interest in learning more about probiotics among consumers worldwide.

The key findings include:

- 75% of the surveyed population reported being very or somewhat familiar with probiotics

Almost half (48%) of respondents consume probiotics daily or almost daily, whether in supplements or in other foods. The survey results suggest that probiotic consumption is driven by an interest in their functional benefits, such as promoting gut and immune health and supporting the microbiome.

- 50% are familiar or very familiar with the term ‘gut microbiome’

The ‘gut microbiome’ is a highly relevant topic for consumers and is associated with health. The majority associate it with gut health followed by immune health, well-being and general health.

- More than half of consumers have received a recommendation to consume probiotics from someone they trust

However, internet research is the most popular way to learn more about probiotics. The flavour of the product and trust are top drivers for choosing and staying with a particular brand of probiotic food.

- Misconceptions about probiotics

Despite reported awareness, there is a range of misconceptions about probiotics. For example, 47% of consumers agree or somewhat agree to the incorrect statement that all dairy yogurts contain probiotics (when in fact most contain live cultures but not all contain probiotic cultures).

- 71% of consumers would like to learn more about probiotics

Consumers are most interested in information regarding health benefits and information that helps them identify which probiotic strains to select.

Local opportunities

Over 1000 Australians were included in the survey and their responses were similar to the global results, says Chr. Hansen ANZ Marketing Manager Lisa Flower.

“Australians are looking for the health benefits that probiotics can support,” she said. “The most preferred benefits found in this study were in the spaces of immune health and gut health. A good quality, live, probiotic, with supporting clinical studies and documentation can help Australian products do just that when used in the right quantities.”

The study found that 13% of Australians were taking probiotics in supplement form, although the overwhelming preferred format is in dairy food, such as yoghurt, with 43% of Australians rating this as their preferred option. For consumers of probiotic food products, flavour was the key driver of choice.

It also found that Australians are looking to the packs of the products they are buying for information on probiotics.

“On-pack, they are looking for health benefits and logos that can simplify messaging,” Ms Flower said.

“When it comes to detailed information about probiotics, we found Australians are turning to good quality websites they trust.”

Last year, Chr. Hansen launched The Probiotics Institute – a digital platform created to help translate the science behind the clinical studies and offers easy to read, high quality, relevant and engaging content on probiotics and specific strains.

As awareness and education around probiotics grow, so do the opportunities to provide consumers with targeted, appropriate products.

“Unlike many countries around the world, Australia and New Zealand food manufacturers are able to meet consumers’ expectations and make general level health claims on foods containing probiotics, where the NPSC [nutrient profiling scoring criterion] is met, the health claim is self-substantiated and the claim notified to FSANZ [Food Standards Australia New Zealand],” Ms Flower said.

“We have seen huge interest in clinically studied probiotics over the past few years and this is reflected in NPD activity and new products in the market, both in food and supplements. For brands where a health proposition makes sense, there remains significant opportunity to meet consumer demand for products containing probiotics.”

So, what lies ahead for gut health products in Australia?

Chr. Hanson’s research indicated particular consumer interest in probiotic cheese, juice and milk.

For more, and to read this Health Series article as it appears in the April issue of Retail Pharmacy magazine, visit: retailpharmacymagazine.com.au/magazine/retail-pharmacy-april-2022